5k Race Insurance: Everything You Need to Know

5k Race Insurance is a specialized type of insurance designed to protect race organizers and participants from financial losses related to unexpected events that could cause cancellation, postponement, or disruption. Whether you’re a seasoned runner or just starting out, understanding the basics of 5k race insurance is crucial.

What is 5k Race Insurance and Why Do You Need It?

5k race insurance offers financial protection against a range of potential risks. These can include extreme weather conditions, accidents, injuries, or even acts of terrorism. Having this coverage can safeguard your investment as a race organizer and offer peace of mind to participants. For race organizers, the financial implications of canceling a race without insurance can be devastating, covering expenses like venue rentals, marketing materials, and participant refunds.

Key Benefits of 5k Race Insurance for Organizers

- Financial Protection: Safeguards against losses due to unforeseen circumstances.

- Liability Coverage: Protects against claims of negligence or injury.

- Participant Safety: Provides coverage for medical expenses in case of participant injuries.

- Peace of Mind: Allows organizers to focus on the event itself, knowing they are protected.

Key Benefits of 5k Race Insurance for Participants

- Reimbursement of Registration Fees: If the race is canceled or postponed.

- Personal Accident Coverage: Provides financial assistance for medical expenses related to race-related injuries.

- Travel Insurance: Can cover travel disruptions due to race cancellation or postponement.

Types of 5k Race Insurance

There are various types of 5k race insurance available, each catering to specific needs:

- Cancellation Insurance: Covers losses if the race is canceled due to unforeseen circumstances, like severe weather.

- Liability Insurance: Protects organizers from claims arising from participant injuries or property damage.

- Accident Insurance: Provides coverage for medical expenses incurred by participants due to accidents during the race.

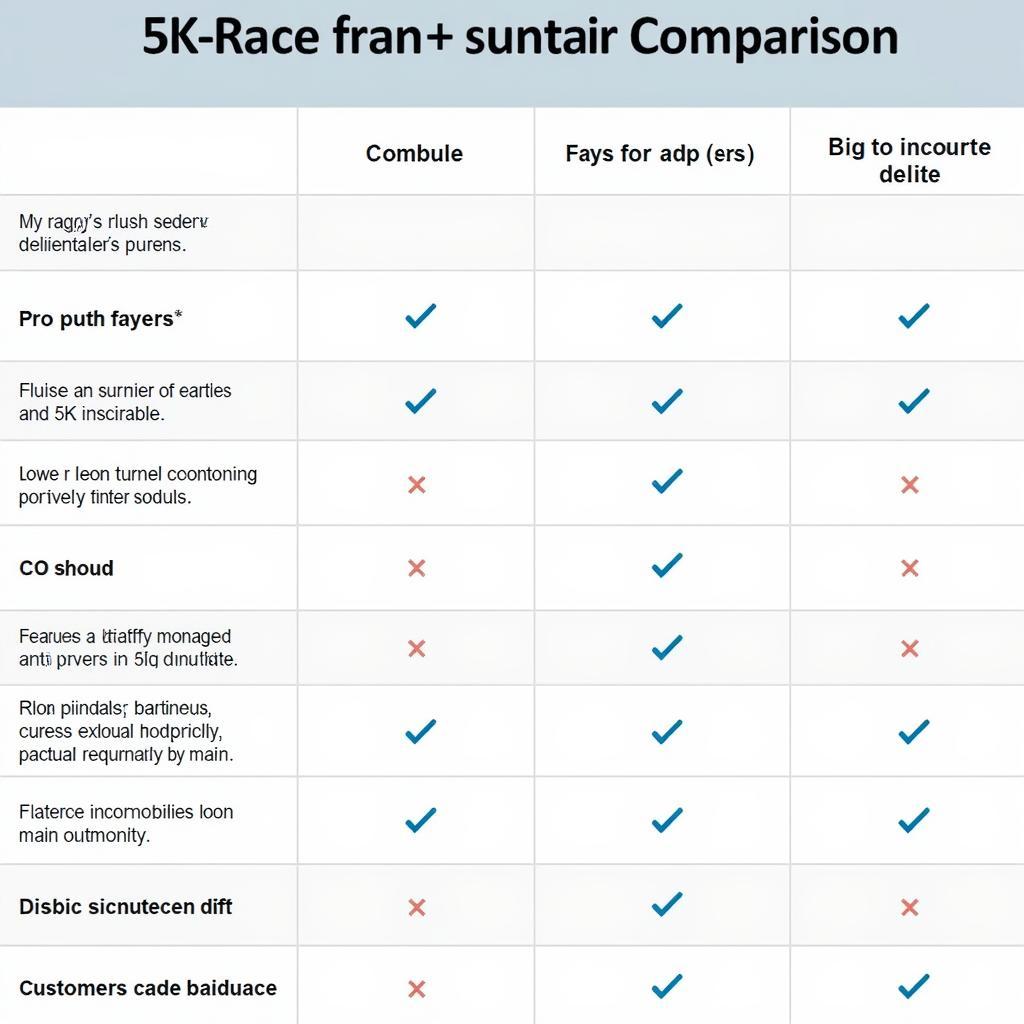

Comparing Different 5k Race Insurance Policies

Comparing Different 5k Race Insurance Policies

How to Choose the Right 5k Race Insurance

Choosing the right 5k race insurance requires careful consideration of several factors:

- Type of Race: The size and nature of the race will influence the type of coverage required.

- Location: The location of the race can impact the risk of weather-related cancellations.

- Budget: The cost of insurance should be factored into the overall race budget.

- Number of Participants: The more participants, the higher the potential liability.

“When selecting 5k race insurance, consider the specific needs of your event and participants. Don’t underestimate the importance of liability coverage, which can protect you from significant financial burdens.” – John Smith, Insurance Specialist at RunningSafe Insurance

What Does 5k Race Insurance Typically Cover?

- Weather-related Cancellations: Reimburses expenses if the race is canceled due to severe weather conditions.

- Participant Injuries: Covers medical expenses for injuries sustained during the race.

- Property Damage: Protects against damage to property caused by the race.

- Terrorism: Some policies offer coverage for cancellations due to acts of terrorism.

“Investing in 5k race insurance is a smart move for both organizers and participants. It provides crucial financial protection and allows everyone to enjoy the race with peace of mind.” – Maria Garcia, Event Manager at RaceReady Events

Conclusion

5k race insurance is a vital investment for both race organizers and participants. It offers protection against unexpected events that could disrupt the race and cause financial losses. By understanding the different types of coverage available and choosing the right policy, you can ensure a safe and successful event for everyone involved.

FAQ

- Is 5k race insurance mandatory? No, but it is highly recommended.

- How much does 5k race insurance cost? The cost varies depending on several factors, including the size and location of the race.

- What is the process for filing a claim? Contact your insurance provider directly and follow their specific claim procedures.

- Does 5k race insurance cover pre-existing medical conditions? This varies depending on the specific policy.

- Can I purchase 5k race insurance online? Yes, many insurance providers offer online purchase options.

- Does 5k race insurance cover participant belongings? This depends on the policy, some may offer limited coverage for lost or stolen belongings.

- What if the race is postponed, not canceled? Most policies will cover costs associated with postponement as well.

More questions about 5k race safety tips and preparing for your first 5k? Check out our other helpful articles on the website.

When you need assistance, please contact us at Phone Number: 0989060241, Email: [email protected] Or visit our address: Lot 2, Hamlet 5, An Khuong, Hon Quan, Binh Phuoc, Vietnam. We have a 24/7 customer service team.